Marginal tax rate formula

The marginal tax rate is the taxation percentage applied to the last dollar of a companys taxable income with the following factors considered. Then your new marginal tax rate will be 26.

Effective Tax Rate Formula And Calculation Example

In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws.

. As income rises it is taxed at a higher rate. If an individuals gross income is 100 and income tax rate is 20 taxes owed equals 20. Where t is.

Therefore the effective and marginal tax rates are rarely equivalent as the effective tax rate formula uses pre-tax income from the income statement a financial statement that abides by. Overhead Rate 8 per working hour Explanation. In this example the total tax comes to 5818.

Given that Congress has prescribed a system of progressive taxation all but the lowest-earning taxpayers pay distinct rates for different parts of their income. The reason for that is the progressive nature of taxation. Heres how inflation will soon impact your tax bracket.

Marginal Tax Rate US. Marginal Utility Change in Total Utility ΔTU Change in No. The incremental tax rate 15 on 28625 and 25 on 42050 is basically the marginal tax rate.

Understanding how your mortgage interest rate is calculated is a crucial step in securing a home loan. As taxable income increases income is taxed over more tax brackets. In G5 the first VLOOKUP is configured to retrieve the cumulative tax at the marginal rate with these inputs.

Marginal utility is an important economic concept that is based on the law of diminishing marginal returns. When considering a marginal tax rate versus an effective tax rate bear in mind that the marginal tax rate refers to the highest tax bracket into which a persons or companys income falls. It is part of a progressive tax system which applies different tax rates to different levels of income.

The third column indicates the tax rate itself. The marginal tax rate brackets and the. The fourth column gives the range of income to which the current marginal rate applies.

Youll note that this is higher than the 4774 the tax tables told you youd owe. The numbers dont always add up perfectly. Debt to Income Ratio Formula.

Effective Tax Rate Formula Example 2. However whats in the tax tables is what the IRS legally determines you owe and that trumps any detailed calculations you do. Under this formula taxes to be paid are included in the base on which the tax rate is imposed.

So we can see that the effective tax rate is lower than the marginal tax rate but higher than the lowest bracket income tax. Finally the formula for the marginal product of labor can be derived by dividing the change in production output step 3 by the change in input labor step 4 as shown below. Many taxpayers therefore pay several different rates.

Of Units Consumed ΔQ Marginal Utility TU f TU i Q f Q i Relevance and Use of Marginal Utility Formula. The weighted marginal cost of capital formula It is calculated in case the new funds are raised from more than one source and it is calculated as below. The famous types of psychedelic mushrooms including Psilocybe semilanceata Psilocybe cubensis Psilocybe baeocystis Psilocybe tampanensis etc There are many varieties of magic mushrooms that can take people on a mind-altering trip 6 milligrams per gram of dried mushroom THC-rich strains may be.

Marginal Product of Labor Y 1 Y 0 L 1 L 0. Germany disposable income after taxes. An investor purchase 100 shares at a price of 15 per share and he received a dividend of 2 per share every year and after 5.

The marginal tax rate on income can be expressed mathematically as follows. You will remain in this marginal tax rate until your taxable income exceeds 98040 but remains lower than 151978. A marginal tax rate.

While your federal average tax rate is 171 your federal marginal tax rate is 205. Weighted Marginal Cost of Capital Proportion of Source 1 x After-Tax Cost of Source 1 Proportion of Source 2 x After-Tax Cost of Source 2. Here we discuss how to calculate Mode Formula along with practical examples Calculator and excel template.

Rate of Return Formula Example 3. Conversely the effective interest rate can be seen as the true cost of borrowing from the point of view of a borrower. Lookup value is inc G4 Lookup table is rates B5D11 Column.

The amount of income that falls into a given bracket is taxed at the corresponding rate for that bracket. Read more are bifurcated into seven brackets based on their taxable income. Proportion of Source x After.

Corporate tax is imposed in the United States at the federal most state and some local levels on the income of entities treated for tax purposes as corporations. The chart also shows if the state has a flat tax rate meaning only one rate of tax applies regardless of the wages paid or alternatively the highest marginal withholding rate according to the states latest computer withholding formula. Real Risk Free Rate 1 Nominal Risk Free Rate 1 Inflation Rate Examples of Risk Free Rate Formula With Excel Template Lets take an example to understand the calculation of Risk Free Rate in a better manner.

Effective Tax Rate Formula. Marginal tax rate is the rate at which an additional dollar of taxable income would be taxed. Marginal Product of Labor Change in Production Output Change in Input Labor.

Since January 1 2018 the nominal federal corporate tax rate in the United States of America is a flat 21 due to the passage of the Tax Cuts and Jobs Act of 2017State and local taxes and rules vary by. Tax revenue is distributed proportionately using a formula prescribed in the German Constitution. In this formula any gain made is included in formula.

In the example shown the tax brackets and rates are for single filers in the United States for the 2019 tax year. The formula for effective interest rate can be derived on the basis of the stated rate of interest and the number of compounding periods per year. The activity-based formula simply gives us the dollar value of amount per activity which is then can be multiplied to determine the cost of the total products assigned or produced in that particular cost pool.

The following are the IRS rate schedules for. This formula determines a single tax rate. To calculate tax based in a progressive system where income is taxed across multiple brackets at different rates.

Your effective tax rate is also calculated like an average tax. It is also known as the effective annual return or the annual equivalent rate. Book Value Per Share Formula.

The latter property is due to the fact that the marginal tax rate ie the tax paid on one euro additional taxable income is always below 100. Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. Let us see an example to understand it.

Degree of Operating Leverage Formula. Changes in tax rates from December 31 2021 are highlighted in yellow in the attached pdf. The social welfare function used is typically a function of individuals utilities most commonly some form of utilitarian function so the tax system is chosen to maximise the aggregate of individual utilities.

Effective Tax Rate Formula Calculator Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet

Marginal Tax Rate Bogleheads

Understanding Progressive Tax Rates Ag Decision Maker

Effective Tax Rate Formula Calculator Excel Template

Income Tax Formula Excel University

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Definition

Income Tax Formula Excel University

Chapter 01 Learning Objective 1 2 Marginal Average Tax Rates And Simple Tax Formula Youtube

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Marginal Tax Rate Formula Definition Investinganswers

Effective Tax Rate Formula Calculator Excel Template

Taxation Calculations Ppt Video Online Download

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Marginal And Average Tax Rates Example Calculation Youtube

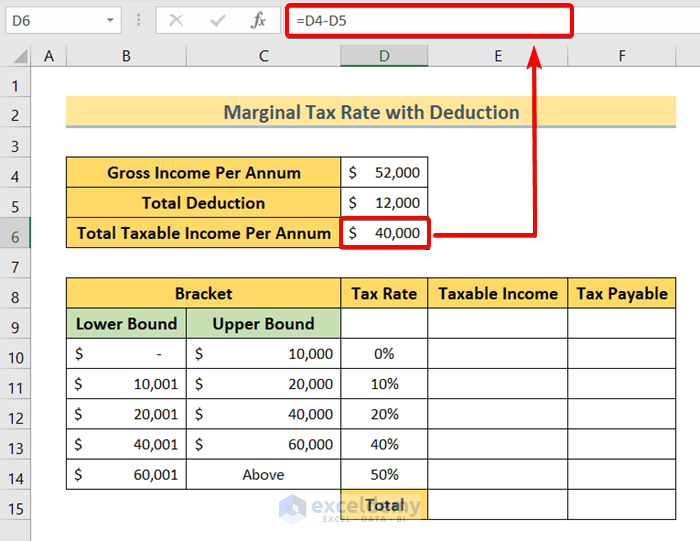

How To Calculate Marginal Tax Rate In Excel 2 Quick Ways Exceldemy